The total amount due for payment seems self-explanatory, right? Not exactly. If you know, for instance, that several large payments are scheduled for the end of the quarter, you can pre-plan for new equipment purchases. Organizing your invoices means you can predict future cash flow and create more precise budgets. The numbers in your sales invoices provide budgeting insights and data for business plans and development. Making use of your business sales analytics is a lot easier with careful invoicing. Knowing what your bestsellers are means you can drive sales and accurately account for demand. This information also feeds marketing strategies for holiday sales or seasonal promotions. You’ll know how much stock you have on hand to fulfill incoming orders and you’ll be able to forecast more accurately based on past data. If your business sells physical products, invoices are doubly important for tracking inventory. A proper system for creating and filing invoices means you’ll never lose track of outstanding payments and can determine exactly when to follow up with clients.Īdditionally, invoices are a valuable resource during tax season and legal proceedings when accurate paper trails are a must. This makes transparent and up-to-date records critical to the cash flow of your business. Frustratingly, the average business spends 14 hours a week chasing down outstanding payments. Invoices are foundational for keeping organized books and accounting records. There are four main types of invoices used for business transactions:īeyond ensuring a company gets paid in a timely manner, a seller’s invoice provides a number of benefits for a company’s sales operations, planning, and forecasting.

Individual item costs should be detailed, as well as applicable taxes, discounts, and prepayments. In order to avoid confusion, the invoice always includes the total amount due. Some businesses issue invoices that are “due upon receipt,” though a 30-day window is considered standard. This might be a specific date or within a defined period. This is also the section that includes the seller’s payment time frame. Payment terms should also include methods of payment, whether that be cash, checks, credit cards, or cryptocurrency. Sellers include payment terms so customers know how and when to pay. Each item appears on its own line with a brief description of the product/service, the unit price, and the quantity provided. The main body of a seller’s invoice details what has been provided to the customer.

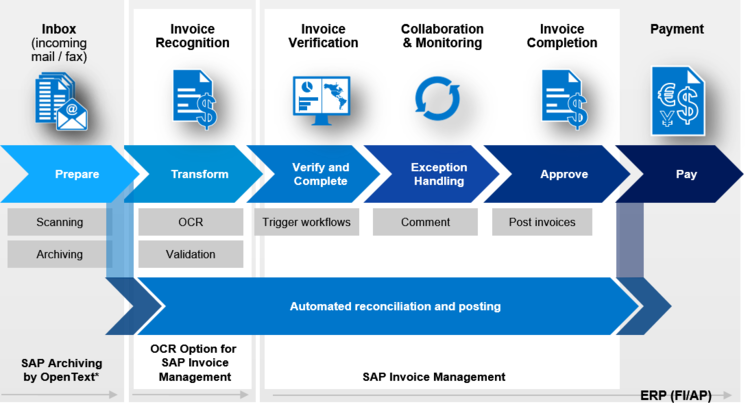

#Invoicing process software

This software often automatically alerts the company and the customer about changes to the invoice so that everyone is kept up to date.

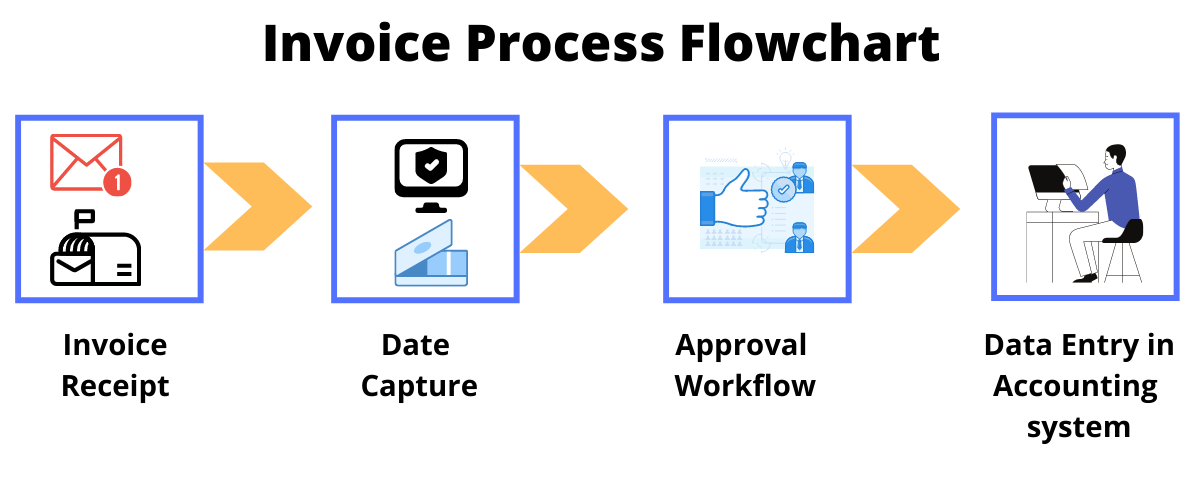

Some use snail mail, but most invoices nowadays come via email or invoicing software. For most companies, invoices are generated at or immediately following delivery. How do sales invoices work?Īt the conclusion of the sales process, businesses create invoices to request payment from customers. Invoices create legally binding agreements between companies and buyers, especially for larger purchases. It records services rendered, items provided, the amount owed by the customer, and how they can make payment. A sales invoice is an accounting document sent by a provider of goods/services to a purchaser.

0 kommentar(er)

0 kommentar(er)